Broken records! That’s what we have been in the run-up to the RBI’s Press Release dated 9th October, 2024 which, among other subjects, also touches upon Climate Risk. If you look at Amukha’s blog page or LinkedIn profile, we have been talking about a preparable shift in policymaking towards addressing ESG concerns in general and climate risk in particular.

We at Amukha believe that the press release where the RBI proposes to create a data repository namely, the Reserve Bank – Climate Risk Information System (RB-CRIS) is a giant leap in that direction. The next steps for the RBI, in our view, would be to identify the focus areas and guide its activities towards those directions.

Given the evolving nature of climate risks, it is critical that financial institutions adopt dynamic risk assessment tools. Amukha’s ESG solution is designed to do exactly that, providing real-time insights that enable banks to identify and mitigate climate-related risks. Our two-pronged approach helps the bank to stay ahead:

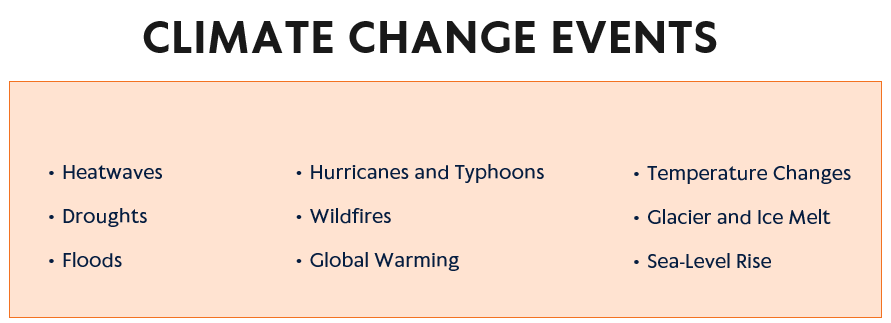

- Real-Time Event Detection

Amukha’s solution identifies climate events across cities, states, and regions, assessing their potential impact on key sectors and companies in those areas.

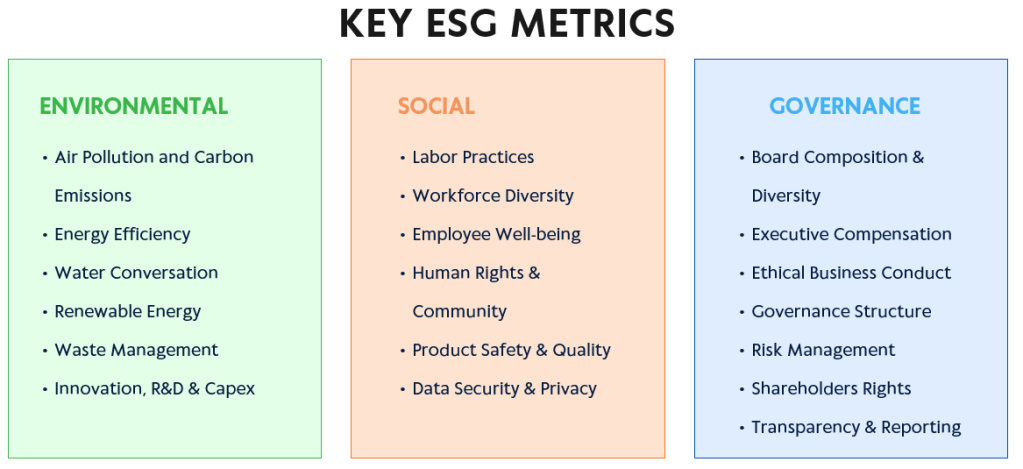

- ESG Risk Scoring & Screening

Our robust entity risk scoring and pre-onboarding screening on vital ESG metrics empower banks to integrate green and sustainable lending practices seamlessly into their operations.

To learn more about how Amukha’s ESG solution can help your bank navigate climate risks, get in touch with us at [email protected]!